south dakota property tax abatement

If your tax assessment is too high you may be able to negotiate a better deal. Mansfield City Council on Tuesday approved a tax abatement request that will assist a 25 million renovation and added new jobs at 1404 Park Ave.

Understanding Your Property Tax Statement Cass County Nd

The states average effective property tax rate is just 053.

. Temporary delay of designation of multiemployer plans as in endangered critical or critical and declining. Thus while property tax rates in the county are not especially high on a statewide basis property tax bills often are high. Illinois is ranked 804th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Retroactive appeals are possible for example by November 1 2021 we can file for 2019. Compared to the 107 national average that rate is quite low. Homeowners and renters over the age of 65 and surviving spouses of any age are eligible for a circuit breaker tax credit permitting an abatement of 50 of the property taxes due.

1 online tax filing solution for self-employed. Getting these removed can make a real difference. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address.

It has been entirely handwritten and signed by the testatorHistorically a will had to be signed by witnesses attesting to the validity of the testators signature and intent but in many jurisdictions holographic wills that have not been witnessed are treated equally to witnessed. This IRM provides policy and procedures for the application of information return penalties assessable under IRC 6721 IRC 6722 and IRC 6723. It also discusses reasonable cause criteria per IRC 6724 and 26 CFR 3016724-1.

This penalty cant exceed 25 of the. As we have seen the NH. In King County Washington property values increased 9 from 2021 to 2022.

Penalties may represent 25 of what you owe to the IRS. Reason for Tax Clearance request. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

The average effective property tax rate in the county is 131 far below the state average of 205. Do not enter information in all the fields. Tuscaloosa County Alabama Public GIS Web19 - f135-Tusc - TuscaloosaAL - 08-15-2022 Parcel Search Max Records.

The move will also help create 18 new positions for one organization and add a bit more breathing room for another. 399 Thus an inheritance tax law enacted after the death of a testator but before the distribution of his. 2021 Homestead Credit Refund for Homeowners and Renters Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for Homeowners and Renters Property Tax Refund Schedule M1PR-AI Additions to Income Rev.

Indiana has a flat state income tax of 323 which is administered by the Indiana Department of Revenue. MANSFIELD -- Mansfield City Council on Tuesday approved a tax abatement request that will assist a 25 million renovation and added new jobs at 1404 Park Ave. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

The average effective property tax rate in South Dakota is 132. Negotiate Your Tax Bill. Likewise the median annual property tax.

121721 Were here for you. Cass County collects on average 191 of a propertys assessed fair market value as property tax. An abatement or reduction of tax-related penalties for one tax period for taxpayers who have incurred tax debt for the first time.

Tax Liens by the Numbers. TaxFormFinder provides printable PDF copies of 70 current Indiana income tax forms. 651-296-3781 1-800-652-9094 wwwrevenuestatemnus Contents Page Do.

The median home value in Norfolk County is 452500 more than double the national average. Reducing penalties through penalty abatement is also something to consider. Dept of Administration bid submission University of Kansas contract State employment Buyingselling business Local government bid submission Fort Hays States university contract Lottery Grantloan application License renewal ABC liquor license Vehicle dealer Angel investment credit transfer Insurance licensing.

A planned 25 million renovation to a property at 1404 Park Ave. When searching choose only one of the listed criteria. The IRS can file a lien against a taxpayers property or assets giving them the right to claim any income generated from these things as a means of settling the taxpayers debt.

West will lead to 18 new jobs for one organization and a bit more breathing room. Modification of exceptions for reporting of third party network transactions. If you want to move to New Hampshire but dont want to pay high property taxes Carroll County may be your best bet.

Check out our new and improved tax calendar so you dont miss key property tax notices and dates. Americas 1 tax preparation provider. What are the penalties for not paying back taxes.

File Form 843 to request an abatement of taxes interest penalties fees and additions to tax. Modification of treatment of student loan forgiveness. There are IRS penalties and interest for late payments and for late filing.

View the full calendar here. When my cousins in Maine received 850 checks from the states COVID relief enabled surplus I wondered what will New Hampshire do with their surplus. All operating division employees who address information return penalties.

Copy and paste this code into your website. First lets address growing property tax values. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners.

The current tax year is 2021 and most states will release updated tax. If any penalties are. Self-Employed defined as a return with a Schedule CC-EZ tax form.

A holographic will or olographic testament is a will and testament which is a holographic document ie. The Business Support Office BSO is. The median property tax in Cass County Illinois is 1480 per year for a home worth the median value of 77300.

Formal Appeal - File an Abatement to the County Auditor by November 1 of the year following the year when taxes are due. GOP has taken the states surplus and pork-barreled property tax abatement for real estate owners into a 500 million dollar spending bill. Tax treatment of restaurant revitalization grants.

County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. That is also well over double the national average. The late-payment penalty is 05 per month or partial month that a tax debt goes unpaid.

A state may apply an inheritance tax to the transmission of property by will or descent or to the legal privilege of taking property by devise or descent 398 although such tax must be consistent with other due process considerations. Those who own homes and mobile homes also receive an additional credit equal to the tax on 20. The median annual property tax payment in Norfolk County is 5592.

Property Taxes Calculating State Differences How To Pay

2022 Property Taxes By State Report Propertyshark

Property Taxes Calculating State Differences How To Pay

Solar Property Tax Exemptions Explained Energysage

Property Taxes By State In 2022 A Complete Rundown

Property Tax Definition Property Taxes Explained Taxedu

Do Solar Panels Increase Property Taxes Green Ridge Solar

Property Tax Comparison By State For Cross State Businesses

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

Property Tax South Dakota Department Of Revenue

Property Tax Definition Property Taxes Explained Taxedu

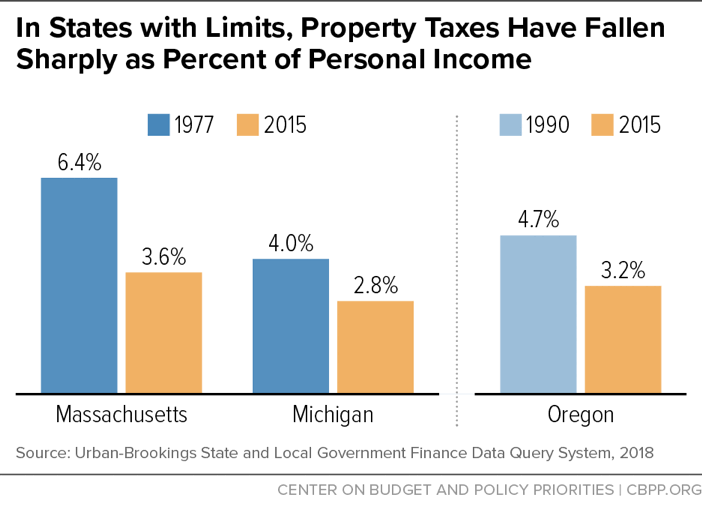

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Property Taxes By State In 2022 A Complete Rundown

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

New Ag Census Shows Disparities In Property Taxes By State

State Corporate Income Tax Rates And Brackets Tax Foundation

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts